×

- Home

- Solutions

- Microsoft Dynamics 365

- Finance and Operations

- Supply Chain Management Service

- Project Operations Service

- Dynamics 365 Human Resource

- Dynamics 365 Business Central

- Dynamics 365 Sales

- Dynamics 365 Customer Service

- Dynamics 365 Marketing

- Dynamics 365 Field Service

- Vertical Solutions

- HRMS- D365 BC

- HRMS- D365 F&O

- Property Management- D365 F&O

- Property Management- D365 BC

- ZATCA E-Invoicing for D365

- Microsoft Business Solutions

- Dynamics AX

- Dynamics NAV

- Dynamics CRM

- Dynamics GP

- Third-Party Solutions

- Warehouse Management

- Retail Management

- Insurance Management

- HR and Payroll Software

- Camp Management

- Click Dimensions

- Pagero E-Invoicing

- Microsoft Power Platform

- Power BI

- Power Apps

- Power Automate

- Power Virtual Agents

- Modern Workplace

- Microsoft Office 365

- Microsoft 365

- Microsoft Teams

- Share Point

- Cloud Solutions

- Microsoft Azure

- Azure Analytics

- Azure AI

- Cyber Security

- Expertise

- Resources

- Know Us

- Contact Us

ZATCA E-INVOICING WITH DYNAMICS 365 Saudi Arabia

Supported regions – UAE (Dubai, Abu Dhabi, Sharjah, Ajman, Umm Al Quwain, Fujairah, and Ras Al Khaimah), GCC (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, Yemen, Iraq), India, Somalia, Lebanon, Indonesia, Pakistan, Africa, Canada, and USA, with Global approach.

By using an integrated electronic solution, electronic invoicing intends to replace the issuance of paper invoices and notes with an electronic process that enables the interchange and processing of invoices, credit notes, and debit notes in a structured electronic format between buyer and supplier. Following an increasing number of nations, the Kingdom of Saudi Arabia (KSA) is the most recent jurisdiction to introduce national e-invoicing.

Boost your convenience with our ZATCA e-invoicing Saudi Arabia. At BEMEA, our skilled experts can offer you best-in-class services to help upgrade your business. Using our ZATCA E-invoicing KSA, UAE, you can expect to run your organisational operations smoothly. We have the tools to help you efficiently implement ZATCA e-invoicing in Saudi Arabia – KSA.

We are Microsoft Dynamics 365 Gold Partner

ZATCA E-Invoicing, Microsoft Dynamics 365 – Automated Sales Invoice Distribution.

Our KSA-based firm understands the importance of fulfilling your requirements. We are eager to map out the needs of your business and provide the necessary tools to achieve a successful future with as much automation as possible.

Book an appointment with us in the Middle East to learn more about E-INVOICING WITH DYNAMICS 365.

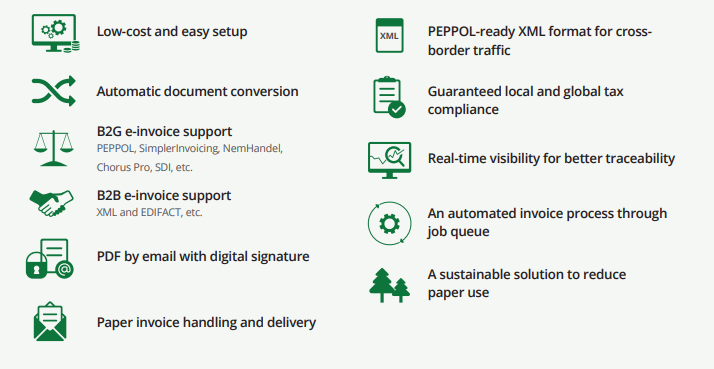

Pagero integrated with Microsoft Dynamics 365

Access Pagero’s open, cloud-based business network and accounts receivable automation services directly from Dynamics 365 (NAV/BUSINESS CENTRAL/F&O)

Send all your sales invoices electronically directly from your Dynamics ERP system to your customers, regardless

of where they are situated in the world. Our experts in the Middle East and KSA are the best people who can help to conduct this process.

Start improving the efficiency of your document flow today!

A single, digital document flow for accounts receivable automation. E-invoicing KSA in the Middle East will make it easier for you to validate the invoice data and elements before issuance. With our presence in the Middle East, it is easy to reach out to our services.

Grow Your Business with Business Expert Gulf

ZATCA E-INVOICING IN SAUDI ARABIA

The Zakat, Tax and Customs Authority (ZATCA) announced the introduction of an e-invoicing law from 4 December 2021. By introducing e-invoicing, organisations can both reduce costs and increase productivity at the same time. They are able to reduce time-consuming manual work and pay more attention to control, business strategy and increased collaboration with clients and suppliers.

WHAT DO I NEED TO KNOW?

- It will come into effect in two stages: generation from 4 December 2021, integration from 1 January 2023

- The law applies to all taxpayers subject to VAT (excluding taxpayers not residing in the Kingdom), in addition

- to any party that issues a tax invoice on behalf of the taxpayer, who is subject to VAT.

- Issuing and keeping electronic invoices, debit and credit notes: an electronic invoice is generated and stored

- in data structured files. Paper, unstructured data files, word, excel, PDF generated documents/ images or scan copies of images are not considered e-invoices.

KEY STEPS OF ZATCA E-INVOICING IN SAUDI ARABIA

-

- Create a cloud-based ZATCA-compliant e-invoice in Dubai and add customers and products

- Manage and keep track of payments, delivery notes, and e-invoices

- Control e-invoices concerning Delivery Notes

Manage bills in relation to Performa bills

Allow clients to settle accounts using SADAD Credit and Debit notes

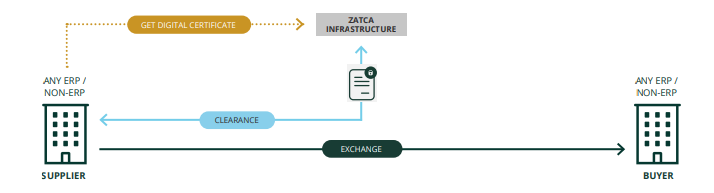

THE ZATCA E-INVOICE PROCESS

Whether you are a buyer or supplier, there are aspects of the e-invoicing process that you must be prepared

for once the mandate is in place. There are two stages involved in the process as defined by ZATCA.

1.) Generation: generate and issue invoices electronically in the ZATCA defined format

2.) Integration: report the invoices to ZATCA

An e-invoicing roll out brings several positive impacts for businesses. Through this digital transformation

opportunity, businesses will experience:

Generate invoices automatically. Never miss billing again!

Ask us about E-invoicing on Dynamics 365 solutions in Saudi Arabia – KSA, Middle East and Globally. Email us at info@bemea.com to set up your first free consultation.

Be Proactive, not Reactive.!